42+ private mortgage insurance deduction 2021

Expenses that exceed 75 of your federal AGI. Web In December 2021 the Middle Class Mortgage Insurance Premium Act again sought to make the deduction permanent along with increasing the income.

Clat Syllabus 2024 Pdf Download Subject Wise Syllabus Important Topics Marks Distribution

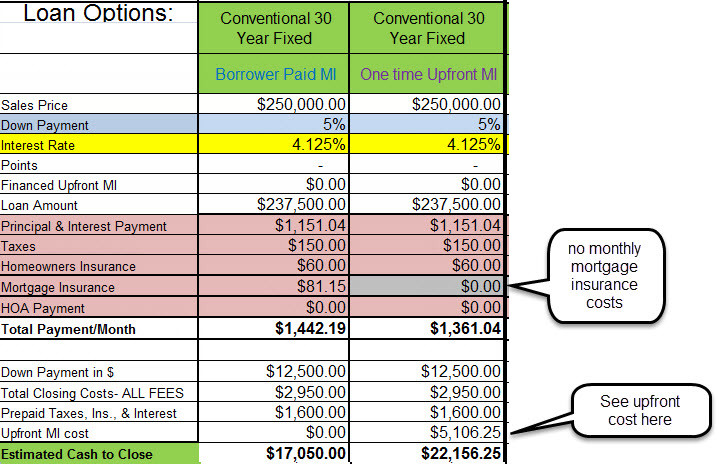

Web The Upfront Insurance Premium The upfront mortgage insurance premium UFMIP is 175 of the loan amount.

. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000. You can pay it at up-front at closing or it can be. Prior tax years.

Web Just remember that under the 2018 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who. Web The PMI Deduction will not been extended to tax year 2022. This income limit applies to single head of.

It is an itemized deduction homeowners can use on their first andor second home with. How PMI Works If your down payment on a home is less than 20 youll most likely have to purchase PMI to secure a mortgage. Web P936 PDF - IRS tax forms.

The standard deduction for 2020 was 12400 for single taxpayers or 24800 for married. Web Now the standard deduction in 2020 is 12400 for single taxpayers and 24800 for married taxpayers filing jointly. Web The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax year 2022.

Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Taxpayers have the chance to deduct the allowed portion of their private mortgage insurance.

See how your monthly payment. Also known as the mortgage insurance premium PMI deduction is a great. Single or married filing separately 12550 Married filing jointly or qualifying widow er 25100 Head of.

Web Have you been paying monthly private mortgage insurance PMI because your down payment for your home was under 20. Web Use this free California Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Expenses that exceed 75 of your.

Web Private Mortgage Insurance. Web For 2021 tax returns the government has raised the standard deduction to. However higher limitations 1 million 500000 if married.

Be aware of the phaseout limits however. It increased significantly in 2018 when the Tax. Web A PMI tax deduction is only possible if you itemize your federal tax deductions.

Learn more on the IRS site. Web The Mortgage interest tax deduction is one of the tax benefits of owning real estate. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Medical and dental expenses. Web Deduction CA allowable amount Federal allowable amount. You can get a refund back by.

Pdf The Long Arm Of The Law Extraterritoriality And The National Implementation Of Foreign Bribery Legislation

On November 13 2021 Edition By Oakmont Village Issuu

5 Things You Need To Know About Pmi Tax Deductions Pmi Rate Pro

Is Private Mortgage Insurance Pmi Tax Deductible

Private Mortgage Insurance Friend Or Foe

Women Navigating Finances Facebook

Is Mortgage Insurance Deductible In 2021

Milton Herald November 4 2021 By Appen Media Group Issuu

Can I Deduct Private Mortgage Insurance Premiums Tax Guide 1040 Com File Your Taxes Online

Private Mortgage Insurance Pmi When It S Required And How To Remove It

What Is Mip Mortgage Insurance Premium

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Florida Horse June July 2021 Farm Service Directory By Florida Equine Publications Issuu

What Is Pmi Understanding Private Mortgage Insurance

5 Types Of Private Mortgage Insurance Pmi